— A 7×24 continuously refreshed strategy candidate pool,

taking quantitative trading from “trying once” to “building a system”

In quantitative trading, what truly consumes time and energy is often not

whether you have strategies, but how to run them consistently, reliably, and repeatedly over the long term.

Many traders go through similar stages:

- Having multiple strategies, but not knowing which one to use next

- Running many backtests, but results are scattered across old tasks and require reconfiguration every time

- Seeing excellent backtest results, only to find live performance completely different

- Being unsure whether previously “optimal parameters” are still valid after market conditions change

The root cause of these problems is usually not the strategy logic itself, but rather:

the lack of a system to retain, filter, reuse, and continuously update strategies.

To address this, PulseForce introduces a new core capability:

the Quant Trading Template Library (Strategy Template Library).

It is not a simple strategy list.

It is a dynamic system maintained by 7×24 continuous background computation and refresh, designed to preserve a pool of strategy templates that stays as close as possible to “usable solutions” under the current market regime.

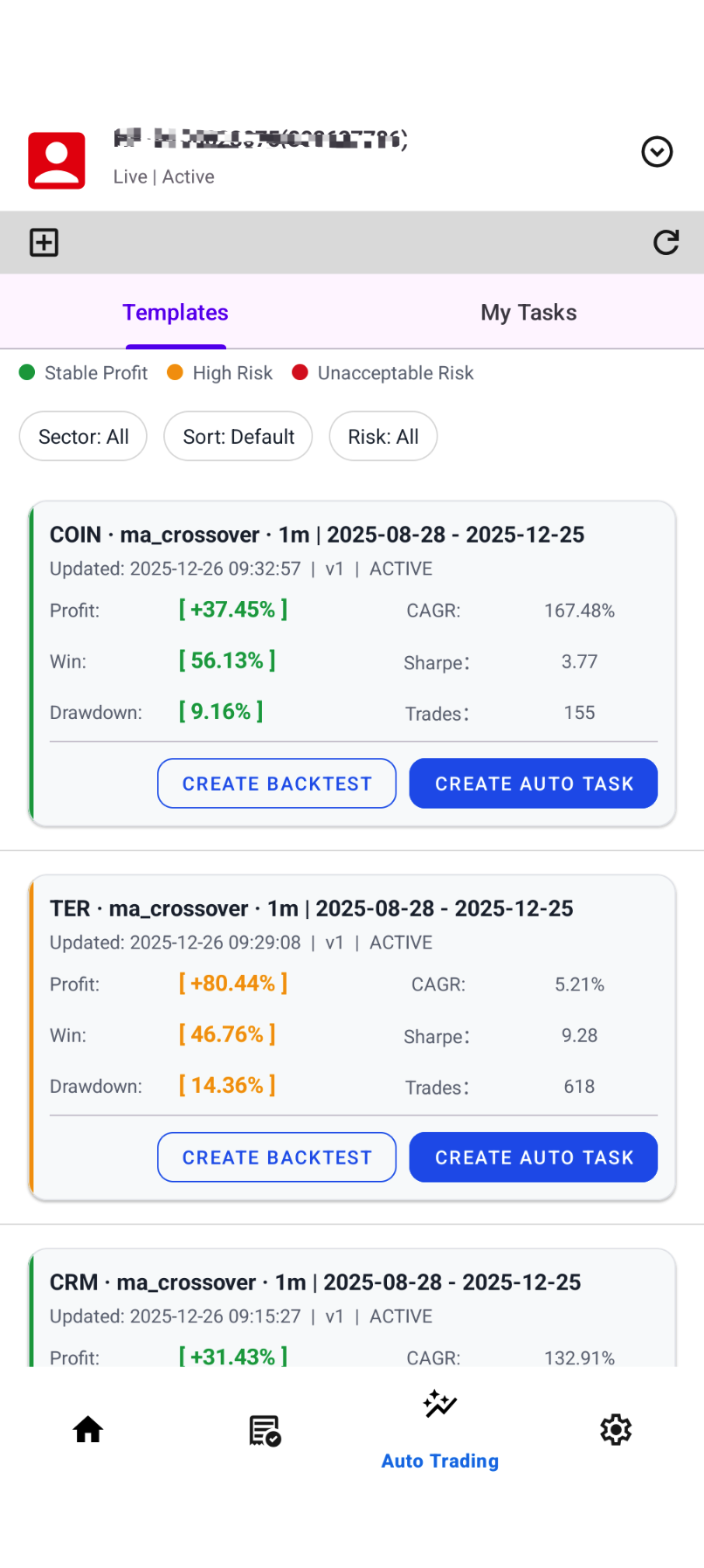

1. What exactly is the Template Library? How is it different from a normal strategy list?

In PulseForce, a template is not an abstract strategy name.

It is a fully validated snapshot of a complete strategy configuration.

Each template contains at least the following information:

- Trading symbol (Symbol)

e.g. AAPL, NVDA, TSLA, or an ETF - Strategy type (Strategy)

such as Momentum, MACD Trend, Bollinger Bands, RSI Reversal - K-line timeframe (Timeframe)

defining the execution time scale - Backtest validation period (Date Range)

indicating which market phase this result comes from - Key performance metrics

Profit, Win Rate, Trades, Sharpe Ratio - Directly reusable parameter presets (Params Preset)

This means:

Templates are not “for reference only”.

They are ready-to-use configurations that can be executed, backtested, or deployed immediately.

2. Why is a Template Library critical for quantitative trading?

2.1 Turning “parameter tuning” into “decision making”

Before the template library, creating a task typically meant:

- Manually selecting a strategy

- Manually entering or copying parameters

- Manually configuring timeframes and periods

- Running yet another backtest

With the template library, this becomes:

Choosing from a set of already validated candidate solutions

The impact is significant:

- New users are no longer discouraged by complex parameters

- Experienced users stop repeating configuration work and focus on comparison and judgment

- Strategy research shifts from being operation-heavy to decision-heavy

2.2 Backtest ≠ live trading? Templates align them by design

A common frustration among traders is:

“The backtest looked great—why is live trading so different?”

In most cases, the reason is simple:

- A parameter was copied incorrectly

- The timeframe was mismatched

- A small configuration detail differed from the backtest

By carrying parameter presets as a whole, the template library ensures that

backtest configurations and live trading configurations stay naturally aligned, dramatically reducing human error.

2.3 Strategies become assets, not one-off results

Without a template library, strategy outcomes are often disposable:

- Run a backtest

- Use it for a while

- Forget it when switching strategies

The template library transforms these results by:

- Structuring them

- Categorizing them by sector

- Ranking them by metrics

- Continuously refreshing them

The end result is a growing, evolving strategy asset library, not a pile of forgotten experiments.

3. Why does 7×24 continuous computation and refresh matter?

Markets are never static:

- Sometimes trending

- Sometimes ranging

- Sometimes highly volatile

- Sometimes extremely quiet

A parameter set that works well in one phase may fail in the next.

PulseForce maintains the template library using a 7×24 continuously running computation system:

- New backtest and validation results continuously enter the candidate pool

- Degraded or outdated templates are gradually replaced

- The same symbol and strategy can evolve into newer, more suitable configurations as the market changes

What you see in the template library is not “historical best”,

but a candidate set closer to what is usable under current market conditions.

4. Sector-based filtering: choose market structure first, then strategies

Different sectors exhibit fundamentally different behavior:

- Volatility profiles

- Trend persistence

- Capital flow dynamics

PulseForce supports sector-based filtering, including:

- Artificial Intelligence / AI themes

- Semiconductors

- Core Technology

- SaaS & Software

- FinTech

- E-commerce / Internet

- Healthcare / Biotechnology

- Growth Consumer

- Industrial / Energy

- New Energy / EV

- Defense / Government-related

- Core ETFs

- High-beta (high volatility) stocks

Why filter by sector first?

For example:

- In Semiconductors / AI, aggressive trend templates with higher drawdowns are common

- In ETFs, higher Sharpe and smoother templates are often more meaningful

- In Healthcare / Defense, templates with too few trades often lack statistical significance

Comparing templates within similar market structures

greatly reduces the risk of mismatching strategy behavior with the underlying asset.

5. What do different sorting options represent?

5.1 Sorting by Profit

Best for:

- Aggressive traders

- Trend-focused strategies

- Those who can tolerate drawdowns

Recommended checks:

- Sharpe ratio (risk-adjusted quality)

- Trade count (to avoid results driven by rare events)

5.2 Sorting by Win Rate

Best for:

- Conservative traders

- Those who value smoother trading experiences

- Users not chasing maximum returns

Important note:

- High win rate does not guarantee high profit

- Some strategies win often but lose big occasionally

Always evaluate together with Profit.

6. How to read template metrics together (a practical example)

Suppose you see two templates:

Template A

- Profit: +38%

- Win Rate: 42%

- Trades: 120

- Sharpe: 2.1

Template B

- Profit: +18%

- Win Rate: 68%

- Trades: 35

- Sharpe: 1.4

Neither is “objectively better”:

- Template A is more trend-driven with higher volatility but stronger risk-adjusted quality

- Template B is smoother with higher win rate, but smaller sample size and lower upside

The value of the template library is that

these trade-offs are visible instead of hidden behind a single metric.

7. From template to task: why one-click deployment matters

Once a template is selected:

- You can create a backtest task to validate it under current conditions

- Or create an automated trading task to run it as a daily strategy

From “seeing a candidate” to “running it live”, configuration friction is nearly eliminated.

8. Forming a long-term loop with Hyper-parameter Optimization (HyperOpt)

- HyperOpt searches for better parameter combinations

- Template Library retains, filters, refreshes, and reuses those results

Together, they form a continuous evolution loop:

Parameter optimization → Backtest validation → Template retention

→ 7×24 refresh → One-click reuse → Further optimization

You are no longer relying on a single backtest result,

but on a strategy system that evolves with the market.

9. Risk Disclaimer

- All templates are derived from historical data and do not guarantee future performance

- Market regime changes may require revalidation or updated templates

- Trading involves risk; strategy signals do not constitute investment advice

- Users are responsible for their own trading decisions

Conclusion

The PulseForce Quant Trading Template Library transforms quantitative trading from:

- “Running strategies occasionally”

- Into “maintaining a continuously evolving strategy asset system”

7×24 Continuous Refresh · Analyzable · Reusable · Executable

This is the true value of the template library.

👉 Google Play Download:

https://play.google.com/store/apps/details?id=ai.hiforce.PulseForceEu

Welcome to PulseForce—where quantitative strategies become professional, systematic, and automated. 🚀